The following are the core requisites for getting instant PAN through Aadhaar-based e-KYC:Ī. On the other hand, you can get the e-PAN for free on the income tax e-filing portal.Īpplying for PAN through this method will automatically link your Aadhaar with PAN.

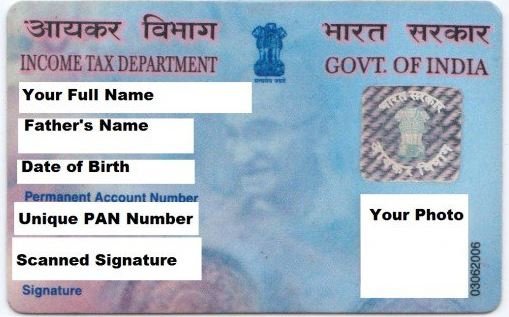

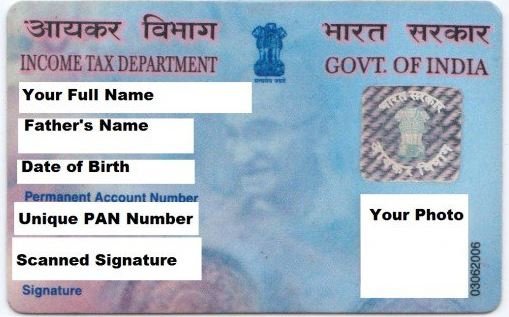

You can apply for e-PAN on NSDL and UTITSL websites, but you may have to pay a fee for the same. The soft copy of the e-PAN will also be sent to your registered email address. You can use the 15-digit acknowledgement number to download the e-PAN from the income tax e-filing portal. The PDF contains a QR code that includes the demographic details, such as the applicant’s name, date of birth, and photographs. The instant PAN Card will be issued in PDF format with no additional charges. The applicants will not be required to submit a detailed application form as in normal cases. The new provision facilitates the allotment of instant PAN to individuals who already possess a valid Aadhaar card.

Income Tax Deductions List - Deductions on Section 80C, 80CCC, 80CCD & 80D - FY 2021-22 (AY 2022-23). Budget 2020 Highlights : PDF Download, Key Takeaways, Important Points. Section 80G – Donations Eligible Under Section 80G and 80GGA – 80G Exemption List.  Budget 2022 Highlights : PDF Download, Key Takeaways, Important Points. Budget 2023 Highlights: PDF Download, Key Takeaways, Important Points. Budget 2023 Expectations For Income Tax: 80C & 80D Limit Increase, Tax Slab Changes For Salaried Employees. Which Is Better: Old vs New Tax Regime For Salaried Employees?. I understand that Security and confidentiality of personal identity data provided, for the purpose of Aadhaar based authentication is ensured by Protean and the data will be stored by Protean till such time as mentioned in guidelines from UIDAI from time to time. Authenticate my Aadhaar through OTP or Biometric for authenticating my identity through the Aadhaar Authentication system for obtaining my e-KYC through Aadhaar based e-KYC services of UIDAI and use my Photo and Demographic details (Name, Gender, Date of Birth and Address) for e-Signing the PAN application.ģ. I have also understood that the Demographic details (Name, Gender and Date of Birth) and/or Biometrics and/or OTP provided by me for authentication shall be used only for authenticating my identity through the Aadhaar Authentication system for this specific transaction and for no other purposes.Ģ. I understand that my Aadhaar data shall be used for the purpose of e-PAN card and my identity shall be authenticated through the Aadhaar Authentication system (Aadhaar based e-KYC services of UIDAI) in accordance with the provisions of the Aadhaar (Targeted Delivery of Financial and other Subsidies, Benefits and Services) Act, 2016 and the allied rules and regulations notified thereunder and for no other purpose.

Budget 2022 Highlights : PDF Download, Key Takeaways, Important Points. Budget 2023 Highlights: PDF Download, Key Takeaways, Important Points. Budget 2023 Expectations For Income Tax: 80C & 80D Limit Increase, Tax Slab Changes For Salaried Employees. Which Is Better: Old vs New Tax Regime For Salaried Employees?. I understand that Security and confidentiality of personal identity data provided, for the purpose of Aadhaar based authentication is ensured by Protean and the data will be stored by Protean till such time as mentioned in guidelines from UIDAI from time to time. Authenticate my Aadhaar through OTP or Biometric for authenticating my identity through the Aadhaar Authentication system for obtaining my e-KYC through Aadhaar based e-KYC services of UIDAI and use my Photo and Demographic details (Name, Gender, Date of Birth and Address) for e-Signing the PAN application.ģ. I have also understood that the Demographic details (Name, Gender and Date of Birth) and/or Biometrics and/or OTP provided by me for authentication shall be used only for authenticating my identity through the Aadhaar Authentication system for this specific transaction and for no other purposes.Ģ. I understand that my Aadhaar data shall be used for the purpose of e-PAN card and my identity shall be authenticated through the Aadhaar Authentication system (Aadhaar based e-KYC services of UIDAI) in accordance with the provisions of the Aadhaar (Targeted Delivery of Financial and other Subsidies, Benefits and Services) Act, 2016 and the allied rules and regulations notified thereunder and for no other purpose.

0 kommentar(er)

0 kommentar(er)